Ready to be happy, healthy & financially wise for life?

Now that you’re a member, this helpful guide will walk you through some of the most convenient features about partnering with us. From all the modern money management services you expect to personalized financial guidance, you’ll quickly experience the credit union difference in banking local.

Mobile Banking lets you manage your account on the go. Download it today and log in with your BayPort username and password so you can:

Be sure to activate Online Banking before logging in to the Mobile Banking app for the first time. If you haven’t enrolled yet, give us a quick call at (757) 928-8850.

We’ve made it easy to monitor your credit for free. With one click, you can check your latest score, understand the key factors that impact it, and learn how BayPort can help you save money.

We’re hosting free virtual financial workshops every month to help you be happy, healthy, and financially wise for life. Learn how to budget like a boss, pay down debt, improve your credit score, and more.

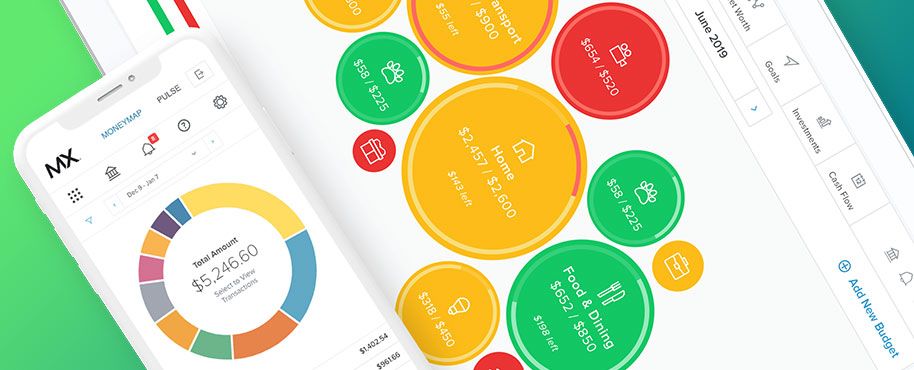

An innovative tool to help you make better financial decisions in real-time. See all your accounts, view transactions, set budgets, get insights on cash flow, and manage debt—anywhere, anytime.

Tap More > Money Management in Mobile Banking

Schedule a 1:1 meeting with one of our 60+ fully trained financial coaches to walk you through establishing a budget, consolidating debt, planning to buy a home or car, and much more.

YourTeller® interactive teller machines are like ATMs with the personality of your favorite teller. Video chat with a live teller to perform complex banking tasks unavailable through a regular ATM.

Whether you need assistance activating Online or Mobile Banking, navigating Credit Score, or personalized financial guidance, we’re here for you.